Investing in the stock market can be an effective way to build wealth and achieve financial independence. However, there are different approaches to investing, and the two most popular strategies are passive investing and active investing. In this article, we’ll compare and contrast these two approaches, their advantages and disadvantages, and how to determine which one is the best fit for your financial goals and risk tolerance.

Table of Contents

- Introduction

- Understanding passive investing

- Understanding active investing

- Advantages of passive investing

- Disadvantages of passive investing

- Advantages of active investing

- Disadvantages of active investing

- Choosing between passive and active investing

- How to get started with passive investing

- How to get started with active investing

- Conclusion

- FAQs

Introduction

Investing is a key component of building wealth and achieving financial independence. However, there are different approaches to investing, and it’s important to choose the one that’s right for you. Two of the most popular investment strategies are passive investing and active investing.

Understanding passive investing

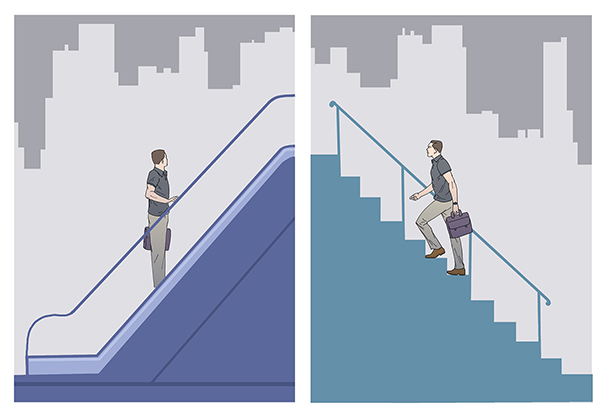

Passive investing involves investing in a portfolio of assets, such as stocks or bonds, that mimic the performance of a particular market index, such as the S&P 500. Passive investors buy and hold these assets for the long term, rather than trying to buy and sell individual stocks in an attempt to outperform the market.

Understanding active investing

Active investing involves buying and selling individual stocks, with the goal of outperforming the market. Active investors try to identify undervalued stocks and sell overvalued stocks in order to generate higher returns than the market.

Advantages of passive investing

One of the main advantages of passive investing is that it’s low-cost. Passive investors don’t need to pay high fees for a professional fund manager, and they don’t need to constantly buy and sell stocks, which can result in higher transaction costs. Additionally, passive investing is more predictable, as investors can expect to earn the same returns as the market.

Disadvantages of passive investing

One of the main disadvantages of passive investing is that it’s less flexible than active investing. Passive investors can’t adjust their portfolio to take advantage of changing market conditions, and they can’t invest in individual stocks that they believe will outperform the market. Additionally, passive investing is more exposed to market volatility, as investors are essentially betting on the overall performance of the market.

Advantages of active investing

One of the main advantages of active investing is the potential for higher returns. Active investors can identify undervalued stocks and sell overvalued stocks, which can result in higher returns than the market. Additionally, active investing is more flexible than passive investing, as investors can adjust their portfolio to take advantage of changing market conditions.

Disadvantages of active investing

One of the main disadvantages of active investing is that it’s more expensive than passive investing. Active investors need to pay for a professional fund manager, and they also need to pay higher transaction costs for buying and selling individual stocks. Additionally, active investing is more risky than passive investing, as investors can lose money if their stock picks underperform the market.

Choosing between passive and active investing

The choice between passive and active investing ultimately depends on your financial goals and risk tolerance. If you’re looking for a low-cost, predictable way to invest in the market, passive investing may be the right choice for you. On the other hand, if you’re willing to take on more risk in pursuit of potentially higher returns, active investing may be a better fit.

How to get started with passive investing

Getting started with passive investing is relatively simple. Investors can choose from a variety of low-cost index funds or exchange-traded funds (ETFs) that track the performance of a particular market index. They can then buy shares in these funds and hold them for the long term. This approach is often referred to as “buy and hold” investing.

Investors should also consider diversifying their portfolio across different asset classes, such as stocks, bonds, and real estate, in order to reduce their exposure to any one market.

How to get started with active investing

Getting started with active investing requires more research and expertise. Active investors need to identify undervalued stocks and sell overvalued stocks in order to generate higher returns than the market. This requires a deep understanding of financial markets, as well as a willingness to take on more risk.

One approach to active investing is to invest in mutual funds or ETFs that are managed by professional fund managers. These funds can provide access to a diversified portfolio of stocks, while also leveraging the expertise of a professional investment team.

Alternatively, investors can choose to invest in individual stocks themselves. This requires more research and analysis, as well as the ability to tolerate market volatility and take a long-term view.

Conclusion

In conclusion, both passive and active investing have their advantages and disadvantages. Passive investing is low-cost, predictable, and easy to get started with, while active investing offers the potential for higher returns but comes with higher costs and risks. The choice between passive and active investing ultimately depends on your financial goals and risk tolerance.

FAQs

- Can you switch between passive and active investing? Yes, investors can switch between passive and active investing depending on their financial goals and market conditions.

- Which approach is better for long-term investing? Passive investing is generally better for long-term investing, as it’s more predictable and less exposed to market volatility.

- How much should I invest in the stock market? The amount you should invest in the stock market depends on your financial goals and risk tolerance. It’s generally recommended to invest no more than 10% of your net worth in individual stocks.

- What’s the difference between index funds and ETFs? Index funds and ETFs both track the performance of a particular market index, but index funds are mutual funds that can only be bought or sold at the end of the trading day, while ETFs can be bought or sold throughout the day like individual stocks.

- Should I invest in both passive and active funds? It’s possible to invest in both passive and active funds in order to achieve a diversified portfolio that balances low-cost, predictable investing with higher-risk, higher-reward opportunities. However, investors should carefully consider their financial goals and risk tolerance before making any investment decisions.