The power of compounding interest is an often-overlooked financial concept that can have a significant impact on your long-term financial goals. Understanding compound interest and how to use it to your advantage can be the difference between retiring comfortably or struggling to make ends meet.

Introduction

Compounding interest refers to the interest earned on the principal amount plus any accumulated interest on an investment over time. The concept of compounding interest is powerful because it allows your money to grow exponentially over time.

Understanding Compound Interest

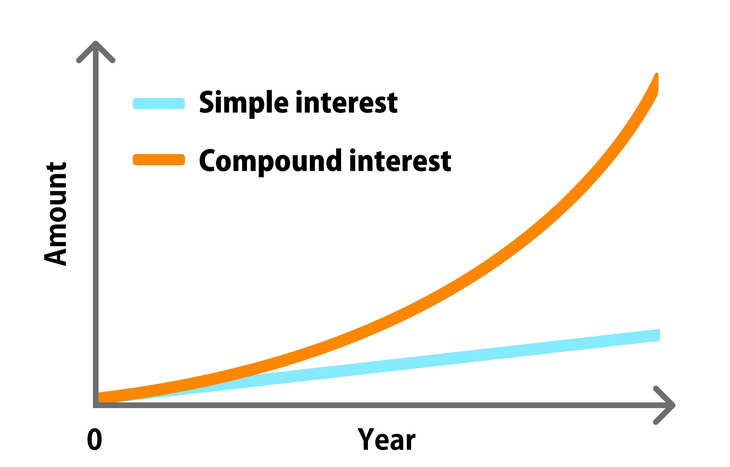

Compound interest is the interest that is earned on the principal amount plus any accumulated interest. In contrast, simple interest is only earned on the principal amount. With compound interest, the interest earned is reinvested back into the account, allowing the account balance to grow at an accelerated rate.

The Benefits of Compound Interest

The primary benefit of compound interest is that it allows your money to grow at an accelerated rate. For example, if you were to invest $1,000 with a 5% annual compound interest rate, after 10 years, your investment would be worth $1,628.89. In contrast, if you were to invest the same $1,000 with a 5% simple interest rate, your investment would only be worth $1,500 after 10 years.

How to Take Advantage of Compound Interest

To take advantage of compound interest, you should start investing as early as possible. The longer your investment has to grow, the more significant the impact of compounding interest. Additionally, regularly contributing to your investments and reinvesting your earnings can help accelerate the growth of your account.

The Different Types of Compound Interest Accounts

There are several different types of compound interest accounts available, including savings accounts, certificates of deposit, and retirement accounts. Each type of account has its own set of pros and cons, and it’s essential to understand the differences between them before choosing which one to invest in.

Risks and Considerations

It’s important to understand the risks associated with investing, including the risks associated with compound interest investing. Additionally, when choosing an investment account, it’s essential to consider factors such as fees, taxes, and potential penalties for early withdrawals.

Compound Interest Strategies

To make the most out of compound interest, there are several strategies you can use. Diversifying your investments can help reduce risk, while rebalancing your portfolio can help maintain a healthy mix of investments. Additionally, keeping your investment fees low and utilizing automatic investments can help maximize the benefits of compound interest.

Conclusion

In conclusion, compound interest is a powerful financial concept that can have a significant impact on your long-term financial goals. By understanding how compound interest works and taking advantage of it through early investing, regular contributions, and reinvestment, you can make your money work for you and achieve your financial objectives.

FAQs

- What is the difference between simple interest and compound interest? Simple interest is only earned on the principal amount, while compound interest is earned on both the principal amount and any accumulated interest.

- Can I benefit from compound interest if I start investing later in life? While it’s always better to start investing early, it’s never too late to benefit from compound interest. Even if you start investing later in life, the power of compounding interest can still have a significant impact on your investments.

- How much money do I need to start investing in a compound interest account? The amount of money required to start investing in a compound interest account varies depending on the type of account and the institution offering it. Some accounts may have minimum deposit requirements, while others may have no minimum requirements.

- Is it safe to invest in compound interest accounts? Investing always carries some level of risk, and compound interest accounts are no exception. However, by choosing reputable institutions and diversifying your investments, you can minimize your risks and maximize your potential returns.

- What happens if I withdraw my money from a compound interest account before it has fully matured? Depending on the type of account and the institution offering it, there may be penalties for early withdrawals from a compound interest account. It’s essential to understand the terms and conditions of your investment account before making any withdrawals.