Credit scores are one of the most important metrics that financial institutions use to evaluate creditworthiness. This article will provide an overview of credit scores, how they are calculated, and how to improve your credit score. We’ll also discuss why having a good credit score is important and how to monitor your credit score to ensure that you’re on track.

Table of Contents

- What is a credit score?

- Why is a credit score important?

- How is a credit score calculated?

- What factors impact your credit score?

- Payment history

- Credit utilization

- Length of credit history

- New credit

- Types of credit used

- What is a good credit score?

- How to check your credit score?

- How to improve your credit score?

- Pay bills on time

- Keep credit card balances low

- Don’t open too many new accounts

- Keep old accounts open

- Monitor your credit report

- What are the consequences of having a bad credit score?

- Conclusion

- FAQs

1. What is a credit score?

A credit score is a three-digit number that represents your creditworthiness. It is used by lenders to evaluate the likelihood that you will repay your debts on time. Your credit score is based on information in your credit report, which includes information about your credit history, such as your payment history, credit utilization, and length of credit history.

2. Why is a credit score important?

Your credit score is important because it can impact your ability to get credit and the interest rates you’ll pay on that credit. Lenders use your credit score to determine whether or not to approve your application for credit and what interest rate to charge you. A higher credit score means that you’re more likely to be approved for credit and qualify for lower interest rates.

3. How is a credit score calculated?

Credit scores are calculated using a complex algorithm that takes into account a variety of factors, including your payment history, credit utilization, length of credit history, new credit, and types of credit used. The exact formula used to calculate credit scores is proprietary and varies by credit bureau, but all credit scores are based on the information in your credit report.

4. What factors impact your credit score?

There are five main factors that impact your credit score: payment history, credit utilization, length of credit history, new credit, and types of credit used.

4.1 Payment history

Your payment history is the most important factor in determining your credit score. It accounts for 35% of your credit score and includes information about whether or not you’ve paid your bills on time. Late payments, missed payments, and defaulting on a loan can all have a negative impact on your credit score.

4.2 Credit utilization

Your credit utilization is the amount of credit you’re using compared to your credit limit. It accounts for 30% of your credit score. Ideally, you should keep your credit utilization below 30% to maintain a good credit score.

4.3 Length of credit history

The length of your credit history is the amount of time you’ve had credit accounts open. It accounts for 15% of your credit score. Generally, the longer your credit history, the better your credit score will be.

4.4 New credit

New credit refers to the number of new credit accounts you’ve opened recently. It accounts for 10% of your credit score. Opening too many new accounts at once can have a negative impact on your credit score.

4.5 Types of credit used

The types of credit you use make up the final 10% of your credit score. Lenders like to see a mix of different types of credit, such as credit cards, car loans, and mortgages.

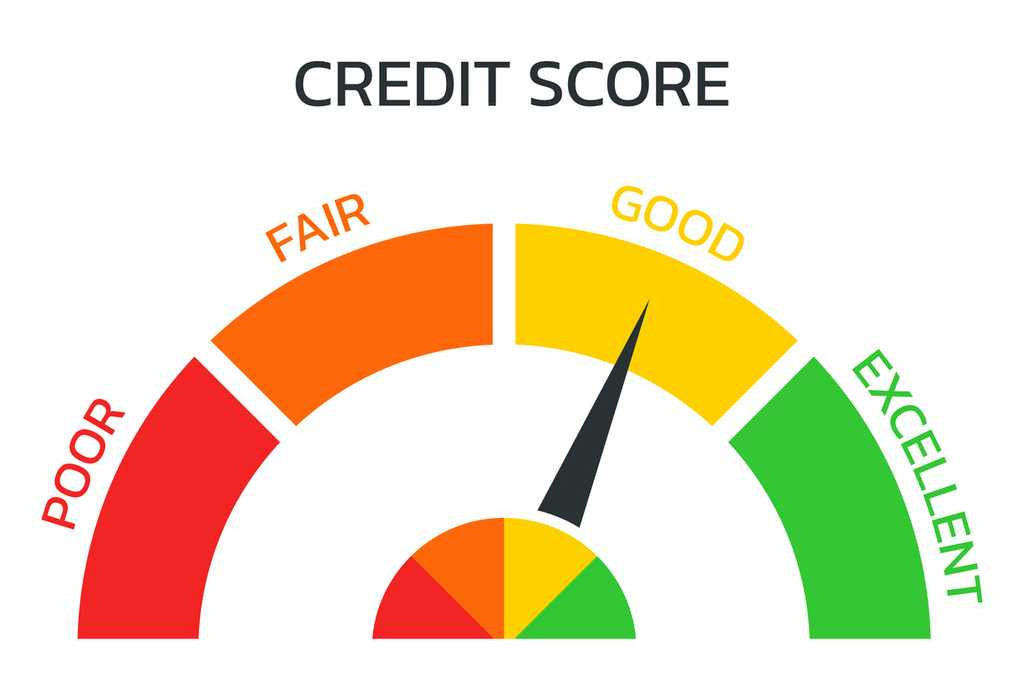

5. What is a good credit score?

Credit scores range from 300 to 850, with higher scores indicating better creditworthiness. A score of 700 or above is generally considered a good credit score, while a score below 600 is considered poor.

6. How to check your credit score?

You can check your credit score for free from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once a year by visiting annualcreditreport.com. You can also use free credit monitoring services like Credit Karma and Credit Sesame to monitor your credit score and receive alerts when there are changes to your credit report.

7. How to improve your credit score?

Improving your credit score takes time and effort, but it’s worth it in the long run. Here are some tips for improving your credit score:

7.1 Pay bills on time

The most important thing you can do to improve your credit score is to make sure you pay your bills on time. Late payments can have a negative impact on your credit score, so it’s important to stay current on your bills.

7.2 Keep credit card balances low

Credit utilization is a major factor in determining your credit score, so it’s important to keep your credit card balances low. Ideally, you should keep your balances below 30% of your credit limit.

7.3 Don’t open too many new accounts

Opening too many new accounts at once can have a negative impact on your credit score. Only apply for new credit when you need it and don’t apply for multiple credit cards or loans at once.

7.4 Keep old accounts open

The length of your credit history is an important factor in determining your credit score, so it’s a good idea to keep old accounts open, even if you’re not using them.

7.5 Monitor your credit report

Monitoring your credit report regularly can help you spot errors and identify areas where you need to improve. You can get a free credit report from each of the three major credit bureaus once a year.

8. What are the consequences of having a bad credit score?

Having a bad credit score can make it difficult to get approved for credit and can result in higher interest rates when you do get approved. It can also make it difficult to rent an apartment, get a job, or even get a cell phone contract.

9. Conclusion

Your credit score is an important factor in your financial health. Understanding how it’s calculated and how to improve it can help you achieve your financial goals and avoid financial pitfalls. By paying your bills on time, keeping your credit card balances low, and monitoring your credit report regularly, you can improve your credit score and open up new opportunities for yourself.

10. FAQs

- What is the best way to improve your credit score? The best way to improve your credit score is to pay your bills on time, keep your credit card balances low, and monitor your credit report regularly for errors.

- Can you get a loan with a bad credit score? It is possible to get a loan with a bad credit score, but it may be difficult and result in higher interest rates. Some lenders specialize in offering loans to people with bad credit.

- How often should you check your credit score? It’s a good idea to check your credit score at least once a year, but you can also monitor it more frequently using free credit monitoring services.

- What is the difference between a credit score and a credit report? A credit score is a three-digit number that represents your creditworthiness, while a credit report is a detailed record of your credit history, including your payment history, credit utilization, and open and closed accounts.

- Is it possible to have a perfect credit score? Yes, it is possible to have a perfect credit score of 850, but it is rare. Having a score of 700 or above is generally considered good and will qualify you for most credit products.